Unlocking opportunities: identifying the winners in the southward shift of population and business

A profound and lasting trend is reshaping the economic map of the United States, offering unique opportunities for investors who are ready to adapt and capitalize on the South’s rapid growth.

Introduction

As highlighted in the Q4 2023 presentation by Cullen/Frost Bank, Texas is now home to 55 Fortune 500 company headquarters. Beyond Texas, the trend of businesses relocating to the South continues to grow. Among the most notable examples are CBRE, Tesla, Oracle, Hewlett Packard Enterprise, Charles Schwab, and Caterpillar. In addition to corporate relocations, there is also a significant population shift from the North and Midwest to the South and Southeast, driven by factors such as warmer climates and business-friendly policies.

For investors, this trend warrants close attention, not only because it has been ongoing for decades but also because it shows no signs of slowing down. By understanding its driving forces, long-term sustainability, and potential impacts, we can adapt our portfolios to capitalize on opportunities or mitigate risks.

This trend has been explored in a white paper by Lawrence Hamtil and Douglas Ott. In this article, I will summarize the key insights from their research and provide my perspective. My aim is to discuss the factors fueling this migration, its implications for different industries, and strategies for investors to navigate this shift effectively.

Part I: Southern Migration Causes and Effects

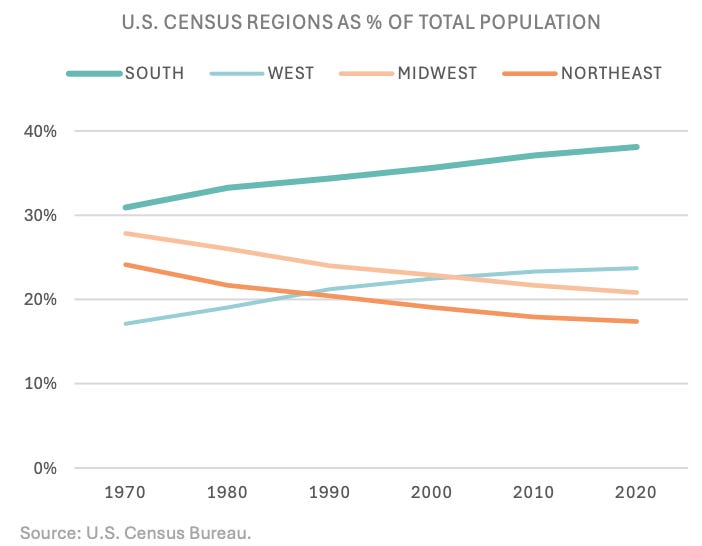

We begin by examining the population side of this trend. This demographic shift has clearly been underway for decades, as evidenced by the data presented in the graphic.

Fifty years ago, the Midwest and Northeast accounted for nearly 28% and 25% of the U.S. population, respectively. Today, these regions represent approximately 21% and 17%. Conversely, the South and West have seen significant growth, rising from 31% and 17%, respectively, to nearly 40% and 25% of the U.S. population. Warmer climates and lower taxes are the primary drivers of this shift, particularly appealing to retirees.

This migration trend is not limited to individuals; businesses are also following suit. It’s not just about new companies establishing headquarters in the South; major corporations are relocating their headquarters from the North, East, and West to the South. This business migration has been underway since the 1970s.

Having provided data to illustrate this trend and a brief explanation of its causes, let us delve deeper into the driving factors. This migration pattern began in the aftermath of World War II.

For much of the post-WWII period, the American South lagged behind other regions in economic development, hindered by the lingering effects of the Civil War and persistent economic struggles. A turning point occurred with the widespread adoption of air conditioning, which transformed the South’s traditionally hot and humid climate into a more livable and business-friendly environment. This innovation not only improved everyday life but also made the region more attractive to both residents and companies, initiating a wave of economic growth.

The trend gained further momentum in the 1950s with the construction of the Interstate Highway System during President Eisenhower’s administration. Prior to this, the South lacked adequate infrastructure, leaving it at a disadvantage compared to the more developed North and Midwest. Federal investments in modern highways changed this dynamic, enhancing accessibility to states like Tennessee, Arkansas, and Georgia. This improved connectivity, combined with the region's warm climate, created a positive feedback loop of investment and migration, laying the foundation for the South’s economic revival.

The region’s appeal has also been significantly boosted by its low cost of living, particularly in energy costs. Southern states benefit from access to affordable land, efficient pipeline infrastructure, and proximity to major energy production hubs like Texas and Louisiana. For example, deregulated energy markets in states such as Texas promote competition, leading to lower prices. As a result, electricity costs in Texas are approximately one-third of those in California, and Florida’s rates are nearly half those of New York. These factors make the South an increasingly attractive destination for businesses and individuals alike.

Beyond the cost of living and energy resources, the South stands out as an attractive destination for businesses due to its favorable economic environment, characterized by lower tax burdens and minimal union presence.

For instance, a comparison between states experiencing significant business outmigration—such as New York and California—and popular migration destinations like Texas and Florida highlights this disparity. As shown in the accompanying image, subtracting the tax burden of the lower-tax state from that of the higher-tax state reveals a clear and widening gap since 1980. This growing divergence further strengthens the appeal of states like Texas and Florida, making relocation an increasingly straightforward choice for both businesses and individuals.

A final key factor contributing to the South’s appeal is its pro-business policies, particularly the widespread adoption of right-to-work laws. These laws prohibit requiring employees to join or financially support a union as a condition of employment. As a result, unions have a diminished presence in right-to-work states, making the South especially attractive to businesses seeking greater flexibility in labor practices.

Currently, 26 states have implemented right-to-work laws, with 14 of them located in the South. This regional concentration underscores a significant competitive advantage. When combined with a lower union presence, these laws further cement the South’s reputation as a business-friendly environment, enhancing its draw for companies.

The combination of affordable energy, modern infrastructure, improved living conditions, and pro-business policies has positioned the South as an increasingly attractive destination for businesses and individuals alike, driving its transformation into a thriving economic hub.

Part II: Industry Implications

The economic and demographic shifts toward the South present both challenges and opportunities for businesses across the United States. To adapt effectively, companies must carefully evaluate regional strengths and emerging trends to position themselves for sustainable growth.

A key driver of southern migration is the retirement of Baby Boomers, many of whom are no longer tied to jobs and are seeking warmer climates and more affordable living conditions. This demographic shift creates significant opportunities for service-oriented industries such as healthcare, hospitality, and leisure, which are likely to experience rising demand in southern states. Businesses catering to retirees—such as those providing healthcare services, financial planning, or recreational activities—should consider expanding their presence in these rapidly growing markets to capture this emerging customer base.

Recent data highlights the challenges northern states face in retaining critical demographics, such as retirees and high-income households. For every individual moving to New York or California, nearly two are leaving, with both states reporting a retention ratio of just 0.6. The search for lower taxes, affordable living, and an improved quality of life, particularly in the South, drives much of this exodus. Businesses in these outflow states should diversify their operations by exploring opportunities in booming southern cities. Establishing satellite offices or relocating select operations to regions aligned with favorable migration trends can help companies access a broader talent pool and position themselves for future growth.

Thus, the key question is : what are the most impacted industries ?

Infrastructure plays a central role in regional development, and the South’s focus on infrastructure has evolved over time. While highway construction was historically a primary concern, current priorities revolve around building data centers and energy-intensive facilities, taking advantage of the region’s generally lower electricity costs. This shift has positioned states like Virginia and North Carolina as hubs for data center activity. Moreover, the South’s growing base of foreign auto manufacturers and other factories demands significant energy, highlighting natural gas and utility infrastructure as key growth sectors.

Aggregates companies—those providing essential materials for construction—are set to benefit from the ongoing development of roads and maintenance projects. Although the South already has a strong foundation of basic infrastructure, many projects now aim to expand capacity in response to population growth. For example, Georgia is developing a two-lane highway exclusively for 18-wheeler trucks, spanning roughly 70-75 miles between Monroe and Atlanta. With an estimated cost of $2-3 billion, this project will improve logistics by diverting large trucks from main highways, enhancing both efficiency and safety. Such initiatives demonstrate the South’s commitment to future-proofing its infrastructure to support continued growth.

Proximity-Driven Market Dynamics in Aggregates and Cement

The aggregates and cement industries operate under unique market dynamics, often creating localized monopolies. The heavy and bulky nature of their products makes transportation costs a major factor, giving a clear advantage to facilities located near construction projects. As a result, the nearest quarry or cement plant typically dominates its market.

Companies like Vulcan Materials and Martin Marietta have secured substantial market share in the South, strategically positioning themselves to meet growing demand. During earnings presentations, both companies frequently highlight southern migration as a key driver for their businesses. Vulcan Materials’ CEO has specifically noted this trend as a critical factor fueling growth, reinforcing the importance of proximity in their business model.

By capitalizing on their regional dominance, companies like Vulcan Materials and Martin Marietta are well-positioned not only to reap the benefits of the South’s rapid growth but also to play a pivotal role in shaping the future of the aggregates and cement industries in the region.

Retailers: expanding footprint and capturing new markets

The ongoing migration to the South presents significant opportunities for retailers, fueled by an influx of both working professionals and retirees attracted to warmer climates, affordable living, and robust job markets.

As cities like Dallas, Atlanta, and Tampa experience rapid population growth, demand for consumer goods, groceries, and services continues to rise. This expanding customer base provides retailers with an opportunity to capitalize on increased foot traffic and higher sales volumes.

Moreover, the South’s lower operational costs—such as more affordable real estate and energy expenses—enable retailers to establish larger stores or regional distribution centers, enhancing efficiency and inventory management. This combination of growing demand and cost benefits positions the South as an ideal region for retailers to expand their footprint, tap into new markets, and thrive within a dynamic and fast-growing economy.

Examples of retailers:

Off-price retailer

Dollar Tree

Five Below

Burlington Stores

Ross Stores

The TJX Companies

Home Improvement and Specialty Retail

Lowe's Companies

The Home Depot

Tractor Supply

Sherwin-Williams

Floor & Decor

Supermarkets and Grocery Stores

Walmart

Target

Costco Wholesale

Winn-Dixie Stores

H-E-B Grocery Company

Publix Super Markets

Kroger Co

Albertsons Companies

Ingles Markets

Sprouts Farmers Market

Restaurants and Fast Food Chains

Restaurant Brands International (Popeyes and Burger King)

Yum! Brands (KCF and Taco Bell)

The Wendy’s Company

Domino’s Pizza

Chipotle Mexican Grill

Starbucks

Texas Roadhouse

Shake Shack

CAVA

Auto and Specialty Parts Retailers

O’Reilly Auto Parts

AutoZone

Homes: The Booming Real Estate and Construction Opportunities in the South

As migration to the South continues to accelerate, the demand for housing is rising rapidly, creating significant opportunities for homebuilders and real estate developers. Companies specializing in affordable and mid-tier housing, as well as those offering luxury homes for retirees, are well-positioned to capitalize on this growth. The influx of young professionals, families, and retirees drives a consistent need for single-family homes and multi-family developments, particularly in urban and suburban hotspots such as Austin, Atlanta, and Nashville.

In addition, the South's growing attractiveness to businesses relocating or expanding in the region is fueling a parallel demand for commercial real estate. This includes office spaces for corporate headquarters, warehouses to support logistics and distribution, and retail centers to serve the expanding consumer base. With affordable land and business-friendly policies, southern states have become prime locations for commercial development.

Construction and Engineering: Building the South’s Future

The surge in residential and commercial development is driving increased demand for construction and engineering firms. These companies are essential for managing large-scale projects, including housing developments, office parks, and critical infrastructure upgrades such as roads, utilities, and public transit systems.

Examples of companies:

D.R. Horton

Lennar Corporation

PulteGroup

NVR

Toll Brothers

By leveraging the region's rapid population growth, affordability, and abundant land availability, companies in real estate, construction, and related sectors are well-positioned to grow in tandem with the South’s thriving economy.

Healthcare and Senior Living: Meeting the Needs of a Growing Population

The South’s fast-growing population, especially among retirees, is fueling substantial expansion in the healthcare and senior living sectors. The region’s affordability and retiree-friendly environment are driving demand for hospitals, clinics, and specialized senior care facilities.

Companies such as Welltower and Ventas are seizing these opportunities by investing in healthcare real estate designed to meet the needs of aging populations. Likewise, operators like Brookdale Senior Living and Encompass Health Corporation are emphasizing integrated care models that combine independent living, assisted living, and rehabilitation services.

Pest control and environmental services: addressing a warm climate

The South’s warmer climate, combined with ongoing urbanization, has created a strong demand for pest control and environmental management services. Companies like Rollins, Inc. and Rentokil Initial plc are experiencing growing opportunities as housing developments and commercial spaces expand.

Pest control providers are leveraging innovative, eco-friendly solutions to address seasonal spikes in demand, while environmental service firms are exploring advanced waste disposal and land reclamation technologies. This sector faces competition from smaller providers, but established players with scalable operations are well-positioned for sustained growth.

Hospitality and tourism: thriving in a growing tegion

As southern cities attract more residents, they are also becoming hubs for tourism and business travel. This trend is boosting demand for hotels, resorts, and leisure facilities. Companies like Marriott International, Hilton Worldwide, and Hyatt Hotels are expanding their portfolios in the South to cater to both tourists and the growing population of business travelers.

In addition, attractions like theme parks, golf courses, and retirement communities are benefiting from the influx of retirees and families. To remain competitive, hospitality providers are integrating technology such as digital check-ins and personalized services, ensuring enhanced customer experiences.

While seasonality and rising operational costs are challenges, the region’s sustained population growth ensures a steady pipeline of opportunities.

Outdoor amenities: the boom in pools and outdoor living

The South’s warm climate and larger residential properties are fueling a surge in demand for outdoor amenities like pools, patios, and outdoor kitchens. Companies such as Pool Corporation, Trex Company, and Pentair are thriving in this market, offering products ranging from swimming pool equipment to composite decking and water treatment solutions.

As more families and retirees move to the South, homeownership trends are driving new pool installations and outdoor living enhancements. Sustainability is also becoming a focus, with eco-friendly equipment and water-saving technologies gaining traction. Despite occasional challenges like water conservation regulations, this market remains robust, supported by the South’s culture of outdoor living and recreation.

Water management and utilities: supporting urban growth

Urbanization across the South has led to increased demand for advanced water management and utility solutions. Companies like Advanced Drainage Systems, Xylem, and American Water Works Company are innovating to meet the region’s infrastructure needs.

Stormwater systems, wastewater treatment plants, and smart water technologies are becoming essential as cities grow. Public investments in modernizing aging infrastructure offer steady revenue opportunities for companies in this space.

However, the high capital requirements and lengthy permitting processes for large-scale projects pose challenges. With sustainability and resource efficiency becoming key priorities, firms that provide innovative, environmentally friendly solutions are well-positioned for success.

Globally, as the population grows and the South continues to expand, business services stand to gain significantly from increased demand. Retailers, Home Builders and Services such as pest control, pool cleaning, and maintenance are already seeing heightened interest. Established companies with a strong presence in the region are well-positioned to scale their operations and outperform competitors. On the other hand, companies that have historically succeeded in the North should seize the opportunity to replicate their business models in the South, leveraging the region's rapid growth to drive expansion and capture market share.

Part III: Sustainability of this trend, where we are and potential setbacks

The migration trend to the South appears robust, but several factors could slow or even reverse its momentum in the coming years. States losing population may attempt to counteract the outflow by adjusting tax and regulatory policies to compete with the South’s advantages. However, many of these states face inherent climate-related disadvantages or lack the urgency to adopt more competitive policies. For now, there’s little evidence that significant changes are being made to challenge the South’s dominance as a migration destination.

Economic and policy shifts

One potential driver of a slowdown is a change in the South’s business-friendly environment. If Southern states were to significantly raise taxes or adopt more stringent regulations—mirroring high-tax, high-regulation policies in the Northeast or California—it could diminish the region’s appeal. While unlikely in the near term, long-term prosperity might lead to fiscal challenges, such as overspending or pension liabilities, which could erode the economic advantages currently attracting people and businesses. Should other regions adopt similar economic climates, the South’s edge could diminish, slowing migration.

Climate and natural disasters

Additionally, climate change poses a significant threat to the sustainability of the South’s growth. The South is particularly vulnerable to climate-related risks such as hurricanes, rising sea levels, flooding, and extreme heat. For instance, states like Florida and Texas frequently experience severe storms, while coastal areas face long-term threats from rising sea levels. These risks have clear economic and social implications, including costly damages to infrastructure, homes, and businesses. Over time, this vulnerability could make certain areas less desirable, dampening their appeal to migrants and businesses.

One immediate consequence is the likely rise in insurance premiums for properties in high-risk areas, which could offset some of the South’s cost advantages. Additionally, climate risks may stagnate or even reduce property values in the most exposed regions, affecting the affordability that has been a significant driver of the migration trend. Furthermore, extreme weather events could strain infrastructure, such as power grids during heatwaves or drainage systems during floods, potentially slowing economic growth and making these areas less attractive for relocation.

External events like climate change and extreme weather pose potential challenges to the migration trend toward the South, yet their impacts are shaped by human behavior and perceptions.

Urban congestion and infrastructure strains

Rapid population growth in Southern cities like Nashville, Atlanta, and Austin could lead to congestion, overburdened infrastructure, and rising housing costs. If these urban centers become saturated, demand may shift to suburban or exurban areas, creating urban sprawl. Without timely infrastructure upgrades, cities may struggle to sustain the influx of residents and businesses, naturally slowing the migration trend.

Human behavior

Despite environmental challenges, human behavior often mitigates their impact on migration. Many individuals prioritize short-term economic and lifestyle benefits, such as affordable housing and job opportunities, over long-term climate risks. This "optimism bias" leads migrants to underestimate their likelihood of experiencing climate disasters, allowing the trend to persist.

Additionally, many trust that modern technology, improved infrastructure, and government intervention will mitigate the worst effects of climate change. This perception of safety can make the risks feel manageable, allowing migration to continue.

But government and business investments in climate resilience—like enhancing flood defenses or upgrading power grids—can help mitigate the impacts of extreme weather, ensuring the region remains livable and economically viable.

Ultimately, the South’s lower taxes, affordable real estate, and pro-business environment remain powerful incentives that overshadow potential setbacks. While climate risks and urban challenges are real, the region’s economic advantages and adaptability continue to drive migration.

For many, the promise of financial stability, improved quality of life, and business growth outweighs concerns about environmental disruptions, ensuring that the South remains a top destination despite potential headwinds.

Leverage unique regional advantages in the North

Despite the migration toward the South, certain northern states retain distinctive advantages that are difficult to replicate.

For example, Silicon Valley remains the global epicenter for tech innovation, supported by a dense network of venture capital firms, highly skilled talent, and an entrenched entrepreneurial ecosystem. Similarly, New York’s financial trading hub continues to dominate due to its robust infrastructure, expertise, and international connections.

Companies deeply rooted in these regions should focus on capitalizing on these unique assets to retain talent and maintain their competitive edge, even as other businesses and populations move southward.

Conclusion and how monitor this trend as an investor

This trend is undeniable and will have both direct and indirect effects across numerous industries and businesses.

For investors, it is essential to assess a company’s capacity to adapt and effectively implement its business strategy in response to these market shifts. For example, the migration from the North to the South creates substantial opportunities for retailers to tap into growing southern markets but also presents challenges for those with operations heavily concentrated in the North. Companies must strategically navigate this trend, balancing the pursuit of opportunities in the South with the need to sustain their presence in traditional markets.

Ultimately, the focus should remain on the earnings potential of the businesses in our portfolios. Companies operating solely in the North may face earnings pressures due to population outflows, while those expanding into the South are likely to experience significant growth. This growth could be driven by access to new markets, cost efficiencies from lower energy expenses, more flexible labor conditions, and economies of scale. The ability to adapt to these changes will determine which companies emerge as leaders and which may struggle to keep pace.

Sources :

White paper :

https://andvariassociates.com/wp-content/uploads/2024/06/2024-06-Andvari-Fortune-Southern-migration.pdf

Podcasts :

Best Anchor Stocks: The United States Is Going South w/ Lawrence Hamtil & Douglas Ott

Security Analysis: Lawrence Hamtil & Douglas Ott: Investment Prospects for the Southern United States